(Note: All USD conversions are approximate, based on an exchange rate of 1 USD ≈ 7.2 RMB)

April saw a significant China EV Market Reshuffle as delivery rankings were unveiled, further disrupting the established order within the new energy vehicle (NEV) landscape. Leapmotor claimed the top spot, followed by XPeng and Li Auto.

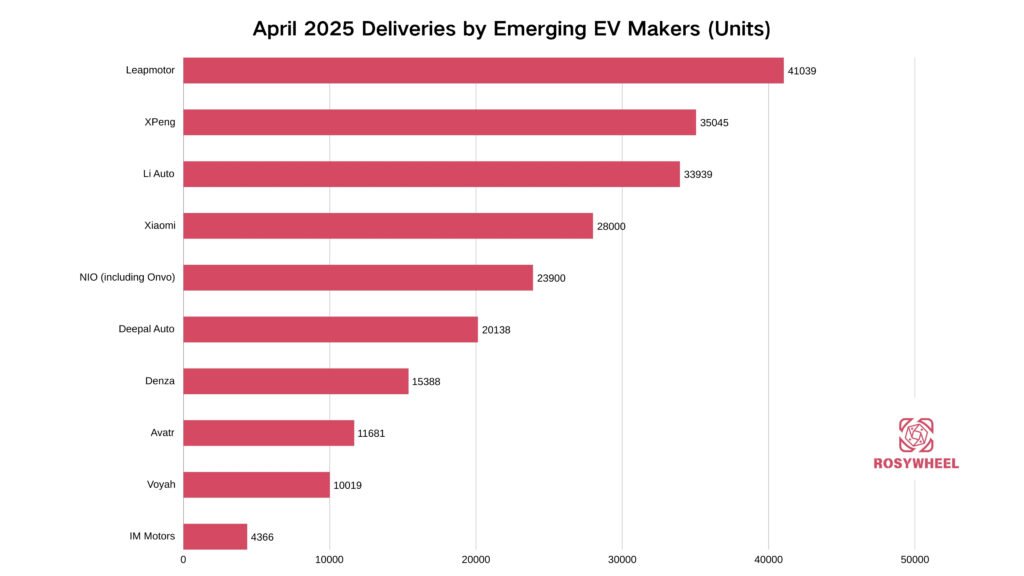

April 2025 Deliveries by Emerging EV Makers

Leapmotor announced impressive April figures early on, delivering 41,039 vehicles, a 173% year-over-year (YoY) increase. This performance surpassed both XPeng (35,045 units) and Li Auto (33,939 units), securing Leapmotor the top position among emerging automakers for the second consecutive month.

XPeng’s deliveries surged 270% YoY, the highest growth rate among the leading players, yet it still trailed Leapmotor by about 6,000 units, landing in second place.

Li Auto, which dominated the rankings last year, was overtaken by XPeng in January and February. In March and April, Leapmotor’s rise pushed Li Auto down to third place.

Xiaomi, having weathered a public relations storm in March, announced deliveries exceeding 28,000 units without providing exact figures, holding onto the fourth position.

NIO (including its sub-brand Onvo) delivered 23,900 vehicles, surpassing Deepal Auto (20,138 units).

Within the “10,000+ club,” competition remained fierce:

- BYD’s Denza (15,388 units), Huawei-backed Avatr (11,681 units), and Dongfeng’s Voyah (10,019 units) formed a stable trio.

- IM Motors (a joint venture between SAIC Motor, Zhangjiang Hi-Tech, and Alibaba) lagged behind, delivering only 4,366 units, widening the gap with other players.

Huawei’s Harmony Intelligent Mobility Alliance (HIMA), including AITO and Luxeed brands, did not release specific April delivery numbers. Zeekr Group, which previously reported Zeekr and Lynk & Co deliveries separately, only announced a combined total of 41,316 units this month.

Key Takeaways from April’s China EV Reshuffle:

- Leapmotor and XPeng demonstrated that the sub-200,000 RMB (~$27,800 USD) market remains key to volume sales, with consumers prioritizing feature-rich vehicles at competitive prices.

- Premium brands face shrinking price premiums, with Li Auto and NIO resorting to subsidies to boost sales.

- Xiaomi and Huawei, while applying internet-style thinking to automaking, encountered challenges: Xiaomi’s SU7 crash incident in March impacted order conversions, making the upcoming YU7 launch in June crucial. Huawei’s HIMA is using new models to overcome Q1 delivery bottlenecks.

Leapmotor & XPeng Lead in China’s EV Reshuffle

Entering 2025, XPeng and Leapmotor have successively reshaped the rankings through affordable strategies. In April, Leapmotor maintained its lead with low-price volume sales, while XPeng saw the fastest growth but was ultimately surpassed.

A year ago, Leapmotor trailed the established “NIO-XPeng-Li Auto” trio. Now, it has not only disrupted this order but has also outperformed Li Auto and XPeng for two straight months. Its April deliveries of 41,039 units showed little month-over-month change but soared 170% YoY, making it the only emerging automaker to exceed 40,000 monthly deliveries.

Leapmotor’s B10 model brought the price of LiDAR-equipped vehicles down to 120,000 RMB (~$16,700 USD), lower than GAC Aion’s non-LiDAR AION Y, while BYD’s LiDAR models generally start above 150,000 RMB (~$20,800 USD). Leapmotor highlighted that 70% of initial B10 orders came from customers aged 25-35, with 36% being female. Their strategy involves the C-series targeting families (similar to Li Auto’s L-series) and the B-series aiming for younger individuals, pursuing both segments simultaneously.

Leapmotor’s 2025 sales target is 500,000-600,000 units (including overseas), requiring average monthly deliveries of 41,000-50,000 units. Compared to nearly 300,000 deliveries in 2024, Leapmotor must answer: Can the B-series sustain this momentum? Can quarterly profitability (achieved in Q4 2024 with 80 million RMB / ~$11.1 million USD profit) be maintained?

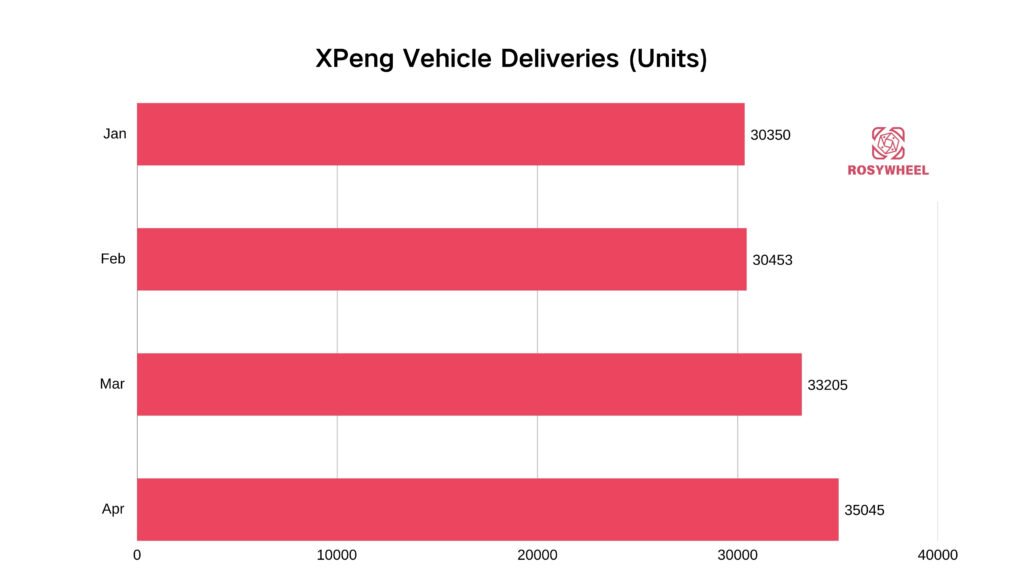

XPeng Vehicle Delivers

Before Leapmotor’s surge, XPeng dominated the first two months of the year. In April, XPeng delivered 35,000 units, a 270% YoY increase (highest growth) but still 6,000 units behind Leapmotor, showing slight month-over-month growth. Deliveries of updated G6 and G9 models accelerated, leveraging price cuts and advanced driver-assistance systems (ADAS). The revised G6, with a price drop to 176,800 RMB (~$24,550 USD), accounted for a higher sales share. The XPeng P7+ Ultra Long Range Max flagship (priced at 208,800 RMB / ~$28,990 USD), launched at the Shanghai Auto Show with upgraded features, also spurred some orders.

While the 2025 XPeng X9 (a high-end MPV priced from 359,800 to 419,800 RMB / ~$49,970 – $58,300 USD) began global deliveries (primarily Hong Kong, Singapore, Malaysia), its impact on April figures was likely limited due to delivery cycles. Facing the formidable Denza D9 EV, XPeng still needs breakthroughs in the premium segment.

Both Leapmotor and XPeng climbed the ranks via value propositions, but XPeng’s strategy isn’t solely low prices. Its popular MONA M03 (a 150,000 RMB / ~$20,800 USD class sedan) succeeded by bringing high-end configurations down to the mainstream market using platform technology, filling a gap for vehicles with advanced ADAS in the 100,000-150,000 RMB (~$13,900 – $20,800 USD) range. The MONA M03 sold 47,000 units in Q1, half of XPeng’s total, ranking 12th among sedans according to China Automotive Data Research Institute (CADRI).

However, penetrating the sub-150,000 RMB market, while boosting volume, raises profitability concerns. XPeng aims for profitability by Q4 2025, necessitating optimization of its profit model (increasing the share of models above 250,000 RMB / ~$34,700 USD) and delivering on its technology reputation (ensuring a reliable ADAS experience). Industry insiders believe profitability hinges on the success of the updated X9 in the high-end market; over-reliance on lower-priced models could lead to larger losses despite higher sales.

Li Auto & NIO: Premium Players Boost Sales with Subsidies

Amid fierce April competition, established players Li Auto and NIO resorted to subsidies to drive sales.

Li Auto reported 33,939 deliveries, up 32% YoY but down 8% month-over-month, dropping to third place. The YoY growth was largely fueled by a combination of cash subsidies and financing policies – the L-series saw price cuts of 10,000-16,000 RMB (~$1,390 – $2,220 USD), coupled with 3-year interest-free loans. While this price war strategy helped stabilize its base, the monthly decline reveals vulnerabilities: losing ground in the premium market and lagging in the pure electric transition.

According to CADRI, the Li L6 sold 44,000 units in Q1 (48% of Li Auto’s total), ranking seventh among SUVs and first among domestic emerging brands. In contrast, the L9 sold 12,200 units in Q1, starkly different from the AITO M9’s 20,300 units.

NIO also showed a resurgence in April, delivering 23,900 vehicles, its first month exceeding 20,000 units this year. The growth primarily came from the main NIO brand, which delivered 19,000 units, nearly doubling month-over-month. However, this seemingly bright data carries risks:

- Onvo (targeting the 150,000-200,000 RMB / ~$20,800 – $27,800 USD market) averaged fewer than 5,000 deliveries monthly in Q1 and delivered 4,400 units in April, a sequential decline, accounting for only 18% of NIO’s total sales.

- Firefly (a 100,000 RMB / ~$13,900 USD class small car), which began deliveries on April 29th, delivered 231 units, still in its infancy.

With less than 10% of its annual target (440,000 units) met in Q1, NIO turned to financial incentives. The April sales rebound is directly linked to offers like “5 years 0% interest + 5 years free battery swapping.” For the ET5 model, this meant a down payment as low as 45,600 RMB (~$6,330 USD) and monthly payments around 3,768 RMB (~$523 USD). Third-party data suggests NIO secured over 3,500 new firm orders during the three-day Qingming Festival holiday after launching the free battery swap policy.

To meet the annual target, NIO needs average monthly deliveries of 31,000 units for the remaining eight months. This heavily relies on sub-brands: Onvo plans two SUV launches this year but faces intense competition from BYD, Li Auto, and others in the 200,000-300,000 RMB (~$27,800 – $41,700 USD) segment, urgently needing a hit model. Firefly needs to leverage the European market to accelerate its international expansion.

Xiaomi & Huawei (HIMA): Former Traffic Kings Face Their Own Troubles

While other NEV startups grappled with price wars, cross-industry giants Xiaomi and Huawei encountered different hurdles.

Xiaomi’s 2025 delivery data shows stability around 20,000 units in Jan-Feb, peaking at 29,000 in March, then slightly declining by 3% MoM to 28,000 in April. This dip is linked to the public relations issues surrounding the SU7 in late March. Although Xiaomi planned to ramp up production in April, the SU7’s positioning around “smart technology” meant incidents involving safety – particularly concerning battery fires and autonomous driving – inevitably caused hesitation among potential buyers.

Furthermore, the NEV market sees rapid iteration and high substitutability. April is a prime month for new car launches, and competitors intensified safety-focused marketing over the past month, likely diverting some orders. According to CADRI, the Xiaomi SU7 sold 75,900 units in Q1, ranking fourth among sedans and first among emerging brands.

Market watchers will closely observe whether the Xiaomi YU7, launching in June-July, features enhanced safety configurations. As one of 2025’s most anticipated models, its success is critical for Xiaomi achieving its 350,000-unit annual target.

Unlike Xiaomi’s direct-to-consumer model, Huawei employs a “technology export” strategy via its HIMA alliance (AITO, Luxeed, etc.), supplying core technologies like ADAS to partner automakers. Since AITO’s debut in 2021, HIMA has expanded to include five brands (“五界” – five ‘realms’ or brands often ending in ‘jie’).

However, since the start of the year, AITO did not release precise delivery figures for January and February; HIMA only disclosed total alliance deliveries and figures for AITO’s main models. In March and April, neither HIMA nor AITO’s main models reported delivery numbers, sparking market concerns about actual order conversion rates.

According to Seres’ recently released Q1 2025 financial report, the AITO brand delivered a total of 45,300 units in Q1, down 45.7% YoY and 53.1% quarter-over-quarter, primarily due to the Chinese New Year holiday impact and model transition periods. Based on this, AITO’s Q1 deliveries ranked behind Xiaomi (over 69,000) but ahead of NIO (42,000) among emerging players.

Model-wise, the M9 delivered 23,300 units in Q1, and the M7 delivered 17,900 units. The higher proportion of M9 sales boosted the Average Selling Price (ASP) to 423,000 RMB (~$58,750 USD) in Q1, contributing to Seres’ gross margin of 27.6%.

For April sales, AITO’s biggest variable is the M8 (pre-sale price 368,000 – 458,000 RMB / ~$51,100 – $63,600 USD). This model adopts a strategy similar to the M9 but at a price point roughly 100,000 RMB (~$13,900 USD) lower, while benchmarking the M9’s features. AITO officially announced that as of April 29th (about 13 days after launch), firm orders for the M8 had exceeded 60,000 units. However, the M8’s delivery capability and order conversion efficiency need validation in Q2.

Conclusion: The Road Ahead in 2025

The 2025 NEV market is undeniably a contest demanding volume, profit, and technology. The winners will be determined across three key battlegrounds:

- Blockbuster Delivery Battle: New models like the AITO M8 (deliveries started), Xiaomi YU7 (June-July launch), Li Auto i8 (July launch), and Onvo L60 (Q3 delivery) face the challenge. Securing massive orders is just the beginning; rapid, safe mass production and delivery are crucial.

- Profitability Defense: Leapmotor and XPeng must prove that low prices can still yield profits. NIO needs to balance its premium positioning with mass-market expansion via sub-brands to avoid deeper losses.

- Technological Breakthrough: Huawei’s ADS 3.3 and NIO’s self-developed chips will face real-world tests. Other players promoting “technology democratization” will compete on ADAS not just on price, but increasingly on safety and higher-level capabilities.

In essence, the NEV players who can successfully capture sales volume, profitability, and technological leadership in 2025 will be the ones to survive the ongoing industry elimination race.